India’s steel sector is poised for transformative growth, driven by the global shift towards sustainability. The whitepaper, “Unlocking Green Steel Demand”, outlines the exponential rise in green steel demand across the automotive, construction, and infrastructure sectors, and the critical steps required to meet India’s ambitious decarbonization goals.

Projected Green Steel Demand Surge

India’s current steel consumption stands at 136 million metric tons (MMT), and is projected to rise significantly — reaching 220 MMT by FY2030 and 390 MMT by FY2050.

The construction and infrastructure sectors together drive approximately 78% of the demand for finished steel in the country. This includes a wide range of applications: the construction sector covers rural and urban housing, commercial complexes and institutional buildings, while the infrastructure sector spans transportation networks, railways, airports, ports, urban transit systems, energy installations, waste and water management facilities.

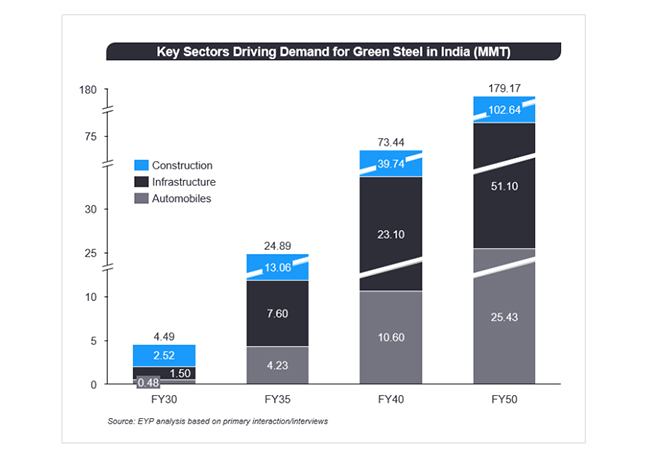

As India rapidly urbanizes, the shift to low-carbon steel in construction, infrastructure and automotive manufacturing becomes paramount. The demand for green steel in India is forecasted to increase dramatically over the coming decades. From a modest 4.49 million tons in FY30, demand will skyrocket to 179.17 million tons by FY50, with the construction sector leading the charge.

By FY50, the construction sector alone is expected to account for more than 50% of total green steel demand, underscoring the necessity for sustainable production pathways.

Green Steel Premium & Economic Viability

The transition to green steel, while essential, does come with a premium – mainly driven by the higher production costs of green hydrogen (GH2) – DRI and electric arc furnaces (EAF) powered by renewable energy.

Currently, the premium on green steel produced through GH₂ DRI technology stands at USD 210/ton, translating to a 3.7% increase in construction project costs, 5.2% in infrastructure projects, and 4.1% in automotive manufacturing.

This premium reflects the relatively high production costs of green steel in its early adoption phase, largely driven by the cost of green hydrogen and the infrastructural investments required to scale up GH2₂ DRI technologies.

By 2030, as technology scales, the premium is expected to drop significantly to USD 7/ton, reducing cost impacts across sectors to below 1% by 2035-2040.

Green Steel Premium Impact on Production Costs by Sector (in %)

| Sector | 2030 | 2050 |

|---|---|---|

| Construction | 3.7% | <1% |

| Infrastructure | 5.2% | <1% |

| Automobiles | 4.1% | <1% |

In contrast, continuing to use BF-BOF steel beyond 2030 could raise production costs by 4% to 13% in nominal terms across all three sectors due to escalating carbon taxes and emissions related penalties.

Supply and Demand Gap for Green Steel

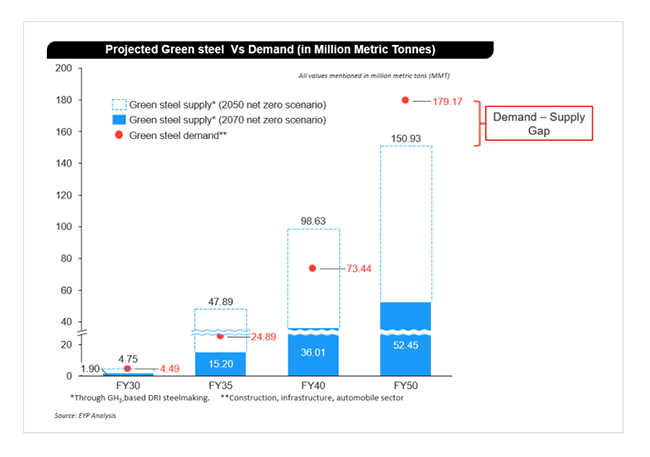

Despite the promising trajectory of green steel adoption, there remains a significant demand-supply gap.

By FY50, India will require 179.17 million tons of green steel yet the primary method of green steel production through GH2-DRI will only supply 150.93 million tons under 2050 Net Zero scenario. This gap will need to be bridged by expanding technologies like scrap-based EAFs and molten oxygen electrolysis (MOE), alongside increased green steel imports.

The Role of CBAM & Policy Interventions

The European Union’s Carbon Border Adjustment Mechanism (CBAM) poses a significant challenge for India’s steel exports. By 2030, the cost impact of CBAM on Indian steel exports could reach ~USD 2,400 million by 2030, and further escalate to ~USD 14,500 million by 2050. These rising costs create significant pressure on Indian steel producers to adopt low-emission technologies and align with EU standards to maintain export competitiveness.

Way Forward: India’s Path to a Sustainable Steel Future

The rise in green steel demand presents both economic opportunities and environmental imperatives.

• Policymakers must implement robust decarbonization policies, including carbon pricing mechanisms, renewable energy mandates and incentives for low-carbon technologies like GH₂ – DRI steelmaking.

• Industry players should focus on scaling up green hydrogen-based technologies and reducing green steel premiums.

• End-use sectors like automotive and construction must increase procurement of green steel to support this transition.

As India leads the charge toward a low-carbon future, aligning with international sustainability standards will ensure competitive edge and contribute to the global decarbonization effort.