India’s steel industry, the second-largest producer globally, stands at a pivotal juncture. As the country continues to industrialise and urbanise, steel demand is set to rise significantly. To meet this demand, the Ministry of Steel has set ambitious targets under the National Steel Policy, aiming for a production capacity of 300 million tonnes per annum (MTPA) and an actual production level of 255 MTPA by 2030. However, this growth brings with it a substantial environmental challenge.

-

India currently contributes 144 MMT (FY23-24) of crude steel production, about 8% of global output, with 43% produced through the coal-intensive Blast Furnace-Basic Oxygen Furnace (BF-BOF) route and 57% through Electric Arc furnace (EAF) – Induction Furnace (IF) routes.

-

By 2032, BF-BOF capacity is expected to increase by 118 million tonnes, and EAF-IF capacity by 24 million tonnes.

-

BF-BOF, which is heavily reliant on coal, is projected to persist and potentially double, causing emissions to rise by 2.5 times from current levels.

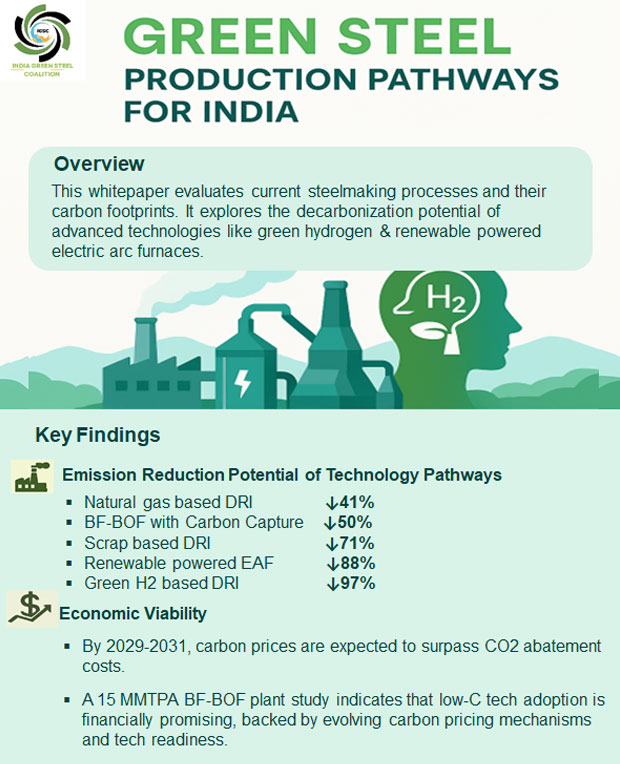

Given this trajectory, decarbonising the steel sector is not just desirable but essential. In response, the India Green Steel Coalition has launched its first whitepaper ‘Green Steel Production Pathways for India’ outlining strategic, technology-driven solutions for a low-carbon steel future.

Decarbonizing Steel Production

The current steelmaking processes in India are heavily reliant on the traditional BF-BOF method, which contributes significantly to carbon emissions. The whitepaper presents cleaner alternatives, including Green Hydrogen Direct Reduced Iron (H2-DRI) and renewable-powered Electric Arc Furnaces (EAF).

Key technologies and their emission reductions include:

-

Natural Gas-Based DRI: 41% reduction in emissions

-

BF-BOF with Carbon Capture: 50% reduction

-

Scrap-Based EAF: 71% reduction

-

Renewable-Powered Electric arc furnace(EAF) and Green Hydrogen DRI: Up to 88% and 97% reductions, respectively.

Economic Viability of Green Steel in India

While green steel technologies are currently more expensive than conventional methods, their economic viability is expected to improve significantly over the next decade. As carbon pricing becomes more stringent and technologies mature, the cost of producing green steel will steadily decline, eventually making it more competitive and even cheaper than conventional steel.

Key Trends:

-

Current Scenario: Green steel production emits 82%–97% less carbon compared to conventional methods. However, the cost is currently 30%–54% higher due to expensive technologies and inputs.

-

By FY2030: The cost of green steel is expected to reach parity with conventional steel, which will become more expensive due to rising carbon costs.

-

By FY2035: Green steel is projected to become cheaper than conventional steel, as carbon pricing penalizes high-emission production routes.

Given these trends, Indian BF-BOF players are well-positioned to begin transitioning. Early investments in green steel technologies will not only reduce emissions but also ensure long-term cost savings and future-proof operations in an evolving market landscape.

Pathways to Green Steel: Strategic Steps

-

Adopt Green Steel Technologies

Transition to green steel by integrating Green Hydrogen Direct Reduced Iron (H2-DRI) and renewable-powered Electric Arc Furnaces (EAF), achieving emissions reductions of up to 97%. Additionally, retrofit existing BF-BOF plants with energy efficiency measures and carbon capture technologies to lower emissions.

-

Policy Support & Incentives

Implement carbon pricing mechanisms and offer financial incentives such as tax rebates, grants, and subsidies to encourage steelmakers to adopt green technologies. A green steel mandate could help foster demand, ensuring a market for low-carbon steel products.

-

Expand Renewable Energy Integration

Scale up renewable energy capacity to ensure stable and sustainable power for steel production. Strengthen infrastructure for energy storage and grid integration to guarantee continuous, reliable round-the-clock power supply.

-

Focus on Carbon Capture & Utilization

Invest in carbon capture technologies to reduce emissions from existing BF-BOF processes. Utilise captured CO2 for industrial applications to support emission reduction goals.

Conclusion

As India’s steel industry looks to meet increasing demand, transitioning to green steel production is crucial for reducing emissions and staying competitive in the global market. By implementing the outlined strategies for greening the steel production and leveraging innovative technologies, steel sector can substantially contribute in meeting India’s Net Zero target.